Secret History of the Credit Card

The average American family today carries 10 credit cards. Credit card debt and personal bankruptcies are now at an all time high.

With no legal limit on the amount of interest or fees that can be charged, credit cards have become the most profitable sector of the American banking industry: more than $30 billion in profits last year alone.

This film examines how the credit card industry became so pervasive, so lucrative, and so powerful as correspondent Lowell Bergman uncovers the techniques used by the industry to earn record profits and get consumers to take on more debt.

Credit card debt is an example of unsecured consumer debt, accessed through credit cards. Debt results when a client of a credit card company purchases an item or service through the card system. Debt accumulates and increases via interest and penalties when the consumer does not pay the company for the money he or she has spent.

The results of not paying this debt on time are that the company will charge a late payment penalty (generally in the US from $10 to $40) and report the late payment to credit rating agencies. Being late on a payment is sometimes referred to as being in “default”. The late payment penalty itself increases the amount of debt the consumer has.

When a consumer has been late on a payment, it is possible that other creditors, even creditors the consumer was not late in paying, may increase the interest rates the consumer is paying. This practice is called universal default.

ALL money in a bank is at risk. It is a very risky "investment" which in the past number of years has nearly ZERO reward for that HIGH risk. Any money you deposit is already gone when only the cash required for a bank to retain is 10 percent of deposits. After your wonderful Congress got rid of the Glass Steagall Act. You bank can use those deposits to gamble with, and many do. Meaning the financial crisis looming could be far worse than 2008... Do Not leave all your cash in a bank. Some of those risky investments banks make and ridiculously call "Assets" on their balance sheets are credit card and mortgage loans to people who cannot pay it back. Nothing has changed since 2008. Banks are still going bankrupt and they still are gambling with high leverage.

Banks have the most effective lobby in congress. Easy to figure why. Then big oil, which banks typically have a large stake in, so it is really a subset of the same people who own your congress and since you do nothing about it, like see to it wise decent incorruptible people willing to vote for term limits are running for all offices from all parties; then you get to live with the consequences of the banks stealing your money through inflation and then deflation (the stuff you bought with your money falls in value).

From the docu description: "The average American family today carries 10 credit cards." Prove it. I don't believe this for a second. It means a lot of people have to have 20 to make up for the millions that don't have a credit card. This is what is called making up crap -or- repeating made up crap. So what else was made up?

Here is one way to deal with the situation: Open an account at a convenient bank. A different bank than the one you have most of your stash in. Get a Debit card for that account and only keep enough in it to pay bills, including online transactions such as ebay or amazon, etc. If some hacker gets your info and cleans out your account. They will only get what you had in there. The bank MUST be separate because the scum banks link accounts and allow hackers to clean out everything. If something bad occurs just open another account at a different bank or credit union and change all online accounts, passwords, etc.

The one caveat with a Debit card is that if you ever go over, they charge you an arm and a leg in fees. If they called it interest, it would be much worse rate than the payday loan outfits that have gotten bad press for outrageous rates from time to time. One just needs to keep track of what they spend.

All other transactions, use cash. If you by some part or item that needs returned. When you buy with cash, you get cash back. When I used to use a credit card, they would issue a refund to the credit card account. Sometimes that didn't happen. Hassle. If you use cash, you know you are getting it back in your hand.

When you use cash at a restaurant, there is no chance for some puke to do something nefarious with your card, or give you back someone else's card, usually on purpose, while they rack up purchases on yours. Like happened to a friend of mine. Tried to take over his ID, the whole bit.

When you use cash, big brother and their corporate helpers aren't tracking you. That is enough reason to use cash.

Bitcoin is an alternative worth considering. Since big brother wants to steal your cash, under the guise of deeming you a suspect if you carry 10k. Bitcoin or similar crypto-currencies seem to be a way to do that. Now if their value should take a dive between the time you purchase and the time you use or convert back to cash, that is the risk.

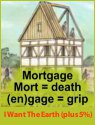

Fact is its a scam. The banks are poachers turned game keepers. If they don't get their monthly cut of interest out of you, if your not taking risks, your never going to be rewarded with a mortgage. I have autism and save for things. Now im 40 and still cant get a mortgage. They said "Get a credit card" but they did this so they could fail me, and lower my credit rating, when I don't even borrow. Thus, like lenin says, they are the ones who benefit from all of this. WAKE UP. ITS TIME WE PUT BANKERS IN JAILS!

1) You need CCs to build up your credit score so you could get a good rate on a car, business, or home loan.

2) You need CCs for some purchases.

3) You could get cash back.

4) Just PAY IT OFF before the end of the month and don't carry over a balance. Take responsibility for yourself.

Wow..interesting that the speakers near the end of the film say that they think the credit card companies will regret (in the future) not having dealt fairly w/ their cc customers.....right!!! Today, banks are not issuing lots of credit cards, unemployment and under-employment rates are STILL at staggering levels post 2008 crash (it is now 2014) and the only ones laughing to the bank are the 1 percenter's (banksters and Wall st. thugs). The game is rigged.....listen....if we lived in a country that kept wages up to rates of inflation, we never would have needed credit cards. The joke is on the workers in the USA (and the taxpayers who keep bailing out the scum banks & wall st. firms).

So true. Thanks for the post!

I kept laughing during this documentary because most of what was discussed in this documentary was solved in the Credit CARD act of 2009. These geniuses saw it coming. Thank you Obama and the bi-partisan efforts at that time.

I use a lot of debit while online shopping, I have a credit card, but only use it for regular billing of services, to get, early pay discounts and such. The credit card is only good for building a credit history or pseudo-emergencies, but its not a real credit (like a mortgage or a student loan which serve a life improving purpose).

not true! I use paypal and online debit for a LOT of places. ALMOST no need for a credit card for online transactions now. If the site doesnt support paypal then i go to its competition that does support paypal, their loss the other companies gain.

Yeah and you can't buy a GD thing from the internet w/o at least 1 card.

If you don't like CREDIT cards, just get a DEBIT card. That's it, very simple.

That's true..... but I'd have to say it has become very hard, since credit card are offered for free in every corner even grocery stores and for somethings you can only pay with credit card. It is kind of like saying if you don't like junk food just eat healthy, it is not that easy when the system is rigged this way.

Great documentary. It foreshadowed what was to come after the 2008 financial crisis... unfortunate it had to resort to that. Plus fees and rates are still very high but at least there is better disclosure.

I actually agreed with the lt the games that credit companies pay but people need to be more responsible too.

obbyist on many points. While the fees are too high, rates should increase after a missed payment because it means greater default risk. Just because that's not the way it works a mortgage work doesn't means it's wrong (plus with mortgages there is collateral). I don't suppor

The people who pay minimum payments are morons. If they cannot afford it then they have no business having a credit card in the first place. Make payments on time and in full and you'll be fine. Otherwise expect to be riped off.

the real issue is that consumers are currently being put into situations where their credit cards are their only form of currency available to them for their basic needs, food, rent, power etc. ive managed to pay with cash for most everything i have, but ive seen many families with worse fate. im getting tired of being the only walking down a boulevard spreading word of anything socially productive and not flyers for raves of pissing people off by talking religion in public. plz get out in the public and inform people, let them see you out there causing a stir, arnt you tired of this giant clusterf--k we call society?

@ Silktop, Axel et al.

There appears to be a general misunderstanding about paying balances in full at the end of the month to avoid paying any interest. Credit cards begin acruing interest on a very low compounding interest rate on a daily basis - FROM THE DATE OF EACH TRANSACTION UNTIL PAID IN FULL.

When balances carry forward into the next month - ie making minimum payments - the interest portion of last month IS EFFECTIVELY CONVERTED INTO PRINCIPLE, AND BEARS COMPOUNDING INTEREST GOING FORWARD, CALCULATED AT WHATEVER INTEREST USURIOUS RATES APPLY + VARIOUS FEES AS CALCULATED BY CREDIT CARD COMPANIES.

@ Mohammed

In the early 1990's, a friend was working in Saudi Arabian hospital in Rhiad, and explained her surprise at how business was done. While shopping for clothes she looked for a changing room, but was told to simply take every piece of clothing home, try them on and return to the store with items she did not want - at which time she would pay for items kept. As I recall - she was even more surprised when the store cashiers did not ask for any money or even make a list of items before she left the store. Same goes for buying furniture - pick-out 2 or 3 different sets of furniture - the store delivers everything, their workmen move each set of furniture in and out until you make a decision - then return to the store without taking any money, leaving it up to her to return to the store and pay for items kept. Possibly the main reason the vast majority of people within Saudi are honest, is because of what is colloquially known by foreigners as "Chop-Chop-Square" - in which theives are subjected to public amputations of their right hand. Foreigners must apply to leave the country - which includes publishing a copy of passport photos in newspapers - at which time any merchants who have been cheated are given opportunity to file complaints - then a trip to Chop-Chop-Square.

@ Mercur,

Bravo - you are the only person to post the obvious answer - JUST SAY NO !

Better still, for people in western countries, it is advisable to consider an alternate plan of action - to use what little credit or equity you may still have - because the entire financial sector is on a precipice of total collapse.

1. Perform an accounting of assets and available lines of credit.

2. Quickly sell all useless or superfluous items to raise cash.

3. Apply for home equity loans and as many credit cards as possible.

4. Acquire 6 - 18 month supply of : food, medicine, guns and bullets etc.

5. Use any spare cash to aquire silver coins and bullion, liquor as barter items

6. Refuse to make anymore payments on mortgages, loans, credit cards et al.

7. Refuse to pay any and all forms of taxation on income, water, property etc.

8. NEVER attend street protests or political rallys - complete wast of time.

9. Protest from the comfort and safety of your livingroom with family.

10. WAIT for sh*t to hit fan - possibly in late 2011 or early 2012.

Do not leave your homes if in foreclosure - because the process is backed-up for literally years due to robo-doc fraudclosuregate problems due to the fact the MERS systems did not require registration of paperwork - resulting in all the bundles of collateralized Debt obligations CDO's and mortgage backed securities MBS' - WITHOUT A CHAIN OF DOCUMENTATION TO DETERMINE OWNERSHIP AND OR CONNECTIONS BETWEEN MORTGAGES AND PROPERTY.

Class action lawsuits are pending to deny mortgage holders, while people who are refusing to make payments often stay in their houses for up to 3 years - WITHOUT MAKING A SINGLE PAYMENT FOR MORTGAGES OR TAXES.

This disaster will likely take at least 5 years to work-out, and you may end-up with a clear title WITHOUT MAKING ANOTHER PAYMENT.

Approx 9 Million homes have already been foreclosed betweeen 2006 - 2009

Approx 6 Million foreclosures happened in 2010

9 M FORECLOSURES ARE PREDICTED FOR 2011, + 2012 + 2013 = 27 M more

Banksters are holding Massive shadow inventory of unsellable houses.

New buyers cannot get title insurance - to prove ownership

Approx 46 Million Americans are presently on food stamps

50 M poor American's have no medical coverage

24% unemployment on average - 35% of people between 18 - 30 unemployed.

ABSOLUTELY ZERO PROSPECTS OF ECONOMY RECOVERING BEFORE 2020

Considering the state of fiscal, polilical and economic instability, with 11 wars waging across MENA, Eurozone and U$$A falling apart, the U$D in total freefall - all 50 states bankrupt and failing municiple bond sales - combined with too many other problems to list - explain why many intelligent people are refusing to fund fraudulent mortgages or taxes - and instead are using their soon to be worthless fiat paper U$ currency to quickly acquire enough supplies and precious metals to withstand a protracted interruption of all services and food distribution - LIKELY TO CULMINATE BEFORE MID 2012.

Peter Carson

cansteel1978yahoo.ca

lol. great predictions, there

Great stuff. If people spent more time watching this than x-factor the world would be a better place

well,too much informative...........i really appreciate this

The woman who is now the comptroller overseeing the banks used to be a lobbyist FOR the banks.

She shows up in another documentary on debt.

AE.

Great information and I realy love your website thanks again and keep it up

@ Pulkit C

very well said.

Universal Default was consigned to the grave in 2009 with the passing of the Credit Card Accountability, Responsibility, and Disclosure Act of 2009.

But what the world really needs is a universal legislation that wipes the slate clean and writes off all of the world's debts. It might sound stupid but frankly if the private jet-owning MBAs, who work very, very hard to come up with elaborate traps to ensnare not-so-smart people, actually turn to lessening the world's financial afflictions with half as much conviction then it could happen. Also to all you private jet-owning MBAs, please pick on people your own f@#$%^& mental size. Don't bully dimwits.

Guys the ads on the right are Google ads and are sourced by taking a word from the title of the page, I'd be more surprised if there was an ad for toilet paper........... although credit cards also involve a lot of c@#$!

@Ramus,

Google ads are contextual and somewhat smart. Google shows different ads for different visitors. For example Google knows your browsing history and your preferences on the Web. Google combines that "info about you" with the info about content on a given page you visit (with Google ads on it) and displays the most suitable match of ads just for you.

Cheers

The money that people have is only as good what they earn.All C.C. company's earn is Interest on what we promise to pay on what we barrow,live on what you earn,not on what you can get.

Yo guys. If the credit card companies are kicking you while you are down STOP PAYING. You can live without a credit history - don't worry.

I got screwed by Bank of America - the evil jackals jacked me to 32% APR and proceeded to kick me when I was down and in a hard spot with money. So I told them to go to hell, not paying.

After 10 months of dirty letters going into the trash, I got a call from a collection agency and worked out a 10,000 payment on 22,000 of debt after selling a car to scrounge up money.

I have no moral problems with this - I tried to work out a full payment deal with Bank of America but they did not want to be reasonable. They wanted me to pay over 30% for the rest of my life.

Wake up sheeple.

Don't we need a credit card to build up our credit history. Everyone needs one. Just use the amount that you could pay for the next month so you don't pay interest rate, and build your credit to pay for a house. You'll need loan to get a house, and you'll need credit for a loan.

Smart people relayed on other's people weaknesses, and they made fortunes.

What if, someday, all the credit card helders will cash out everything and don't make their back-payments?

right next to the video. on the right

Hey Im watching in Australia and there's also an ad for...NAB American Express and Mastercard credit cards win frequent flyer miles on Qantas!

(yes its funny the bank is called NAB-stands for National Australia Bank lol)

I actually watched a different documentary on predatory lending, but more harsh than this FrontLine documentary, and what it revealed was quite shocking but not surprising!!! The key to credit is to use it responsibly, not to rely on it to get by daily. Many Americans live FAR ABOVE their means all in the pursuit of the "American Dream." Unfortunately, that dream died many years ago during the Reagan Era, yet Wall Street continues to lie to the middle and upper-middle class that they too can be "rich."

I'd rather be debt free and living comfortably, than to be in debt and living in fear. This whole financial scheme is a new form of SLAVERY folks!!! Sad thing is, the shackles are so heavy that we may NEVER become free, unless we finally realize that if you can't afford it with cash then you don't damn need it!!!

One last comment on this: If you notice, nowadays, everyone is materialistic and so superficial. Everyone has forgotten about life's true meaning and what life is all about; how to enjoy what has been given to us; how to appreciate the simpler things. We as a nation are too focused on a 11 bedroom house, with a Mercedes and a Range Rover in the drive way, designer clothes and shoes, and super white teeth!!! The world is just shaking their heads at us (and I'm sure laughing as well).

The once richest nation and superpower of the world is now trillions of dollars in debt to several world banks and countries, how can you expect its citizens to behave any differently?!?!?!

Never used a credit card, in my country ,Italy,i use the bank account card, which is connected to my personal bank account. I make payments with no taxes and fees for the use. For E-shopping i use a Prepaid-card Visa, witch is rechargeable and i pay a fixed fee for every transaction of 1(one) Eur. I pay with this card and get payed on this card. Like a bank account .No credit , only real money, that i have. This is the system in Italy. Unfortunately i see many people using credit-cards, even for groceries.

It's not surprising that credit card companies are given the green light to place poor and working class people into perpetual monetary slavery. Credit card companies were founded by criminals; the entire international banking system was founded and are being run by criminals!!

DEBT anyone?

as muslims we dont take interest on loans its against islam.there is credit with no interest.

@ silkop

Amen to that my brother my thoughts exactly.

@Silkop - "don’t forget to also cut the CEO’s salary. This could also be done with taxes"

Explain how you devised a way to tax that wont be passed onto the consumer.

@Silkop

YES! Exactly! My observations, as well!

And well put!

@Randy Hi :-)

Yes, the attitude is apparent everywhere because simple self-righteous explanations 1) appeal to the masses 2) make the world appear nicer than it really is.

Look at European politics right now. It's always someone else's fault. If Greece defaults on its debts, then it's either fault of the lazy Greek people, or of evil bankers who "made" them borrow, maybe of some evil anonymous speculators who are "attacking the Euro currency". Nobody is going to say it's OUR fault, that WE are the dumb bankers, WE (or maybe our American "friends") are the speculators, WE are the EU officials who farted in their chairs instead of overseeing the lending projecs (at best people will bark about "them corrupt politicians"), and finally WE are those who let them take those risks on our behalf beause WE want to live a great life. In many cases such risk taking pays off, but then, of course, nobody complains.

Plus, it's only noticed if bad things happen close to home. People being exploited by us (not necessarily the U.S.) in the third world? Uh yes, I guess it's not right, let's send them some missionaries, make them pray and sing a song. We can keep the profits anyway... because we have our "debt problems" after all.

So I say: let's just be honest to ourselves about what is going on in the world and which forces have been driving our behavior throughout history. It's almost never black and white.

@silkop

Indeed. I have said many times all over this site to people that are full of hate towards "evil corporations" etc.

I say, "Then why did you give them all of your money?"

We made them more powerful than our own government with OUR greed. (Well, not me, I never want to give ANYBODY my money...), so now, you take the consequences.

Live with it, or learn from it, but stop b*tchin' about it.

I think is what you were implying...

(OH! And great to see you again, Silkop!)

If you think that an evil company X is making astronomic profits to the detriment of society, maybe you should take class action and buy shares in that company, then spend it on charity. While at it, don't forget to also cut the CEO's salary. This could also be done with taxes, but for that you would need honest statesmen.

The real problem here is that dumb people don't realize how dumb they are and are ripped off. We have this "problem" everywhere. Pointing a finger at a single industry won't help much. It can get worse if the dumb cause the situation to deteriorate so that even being smart (but not resourceful enough) does not prevent you from being exploited. Dumb people making debts which smarter people have to pay off later is alarming. This is why it's generally the right idea to educate and restrict the dumb rather than milk them and let them run rampant.

Credit cards have there uses. I used to travel for work and could easly run up 20k in a month. I got so many "miles" and "points" that I would buy people plane tickets for birthday presents and use the points on my card for christmas shopping. I love my credit card and still make all my purchases with it. I have even been extremely pleased when I made a purchase that turned out i needed to contest. My card refunded me the entire amount.

I guess a credit card is like a bottle of whisky... it just shouldnt be in the hands of some people.

@Randy

Yep most people don't notice it because the internet nowadays is full of advertisements... It's almost the same way as TV advertisements work... Just show it over and over and over again, and hope it sticks in peoples minds..

I just woke you up didn't I ?! :-)

The very WORST!

Wow I didn't even notice that, until you pointed it out...

Wow!

@Randy

Yeh, and it's not "just a creditcard"... it's even worse... it's CITIBANK... It just can't get any worse than that...

Whahaha... the irony

@me

OMG!!! HAHAHA! Yes, thank you for translating that, WOW!

I mean, WOW! I mean, what a mind-f--k, eh?

I'm watching this docu and guess what... :

On the right side of the video (between the video and the text "Documentary Categories") there is an advertisement which states (it's in Dutch so I'll translate it) :

"Citi Visa CreditCard, Every year €20 gift, For life. Request it online. Citibank, together we'll make it happen."

I don't think they're gonna get any customers on this webpage :-)

@vik

Sorry, yes Bollywood! I have a whole cable channel devoted to Bollywood movies and I watch them...

(Mostly because I think Indian women are BEAUTIFUL.... sorry... I hope that is not dis-respectful!)

And, vik, look up Irish people. We are crass compared to your culture but we threw off the English yoke just like Ghandi-gi did!

Well, we did it with violence and Ghandi-gi did it with non-violence... so... his was better... BUT, we made really great songs about it!

@randy

I dont know about Irish People,uhh!!! Bt I know abt American , Indian PPPPLLL & Hope i get ur Irish joke lol!!!

Yes i readed your earlier posted which were very wise & straightened . Correct YOu Its "BOLLYWOOD" .....lol

regards

@vik

Well, seriously, you are very wise. And as you might see from my earlier post, I always recommend discipline and savings, as do you.

And you also see, as I do, that economics are a "living" thing that moves and grows like the people that created it.

I get that.

So... that means you won't hurt me, right? You guys like Irish guys right? I love Baliwood movies... with the dancing and the singing!

LOL! Just a joke!

Namaste!

@randy

Namaste! :-)

It cant say who hurt whome ,, but i can says that I will hurt who owns it . I see this way "Creator of system get himself get trashed himself in it ". In a globalized world You might have seen or may be going to see domination effect on one by another(US-china)

I dont want to put very much economics behind it .The general idea is people need to understands this & there personal saving

behavior so that there future get secured & fruitful for all (incl urself , Country micro Economy ) .

As I describe earlier

that Money Moves , so its business cycle which moves this . So better be prepared . Mind it "Credit Money Is Illusionary Money

you may feel it there but Its not there as a money sence.

Regards

I was watching the very beginning of this and I thought to myself, "hey that looks like sioux falls," then the narrator says, "this is sioux falls, south dakota..." lol i live there. just found that funny.

@vik

LOL! That IS a great saying! The great Indian people may end up owning me, (a US citizen), one day, so I bow to your wisdom!

Namaste!

(How do you feel about the Irish?)

The "sucking-up" is just a joke, you get that, right vik? You guys won't hurt us or nuthin'... right? We're pals, right?

This is very Interesting & fishing Methodology how the credit business works . Just like any other Consumer product in which they highlights merit in Broader terms & demerit in miner terms to catch the consumer to spend more more more ..

I wish the doc comes early so that ppl should learn how dangerous r there CC is . Even though CC companies earn interest profit but not so long as most of there creditor get default & unable to pay what they won to , companies get bankrupt or crashed down , I dont want to name them as whole world knows tens of credit card / mortgage companies in USA .

This things will cont'd in the future as long as the money moves in the economy but people need to understand their spending behavior , limits & delimits "

HERE IS GREAT SAYING IN INDIA

" DONT SPREAD YOUR LEGS OUT OF THE REACH OF UR BLANKET "

My wife and I have lived "plastic-free" for over 14 years now. Credit cards are evil.

If you want something and you don't have the cash, either save for it, or you don't need it.

If you don't have the cash for food or gas, then you can't afford it, and you need to re-evaluate your life.

NEVER buy food or gas or any instantly consumable item with credit cards. You will be paying interest for years and years on something that is, literally, gone tomorrow.

It takes discipline and patience, but that is what makes a mature, grown-up person.

There are NO "good" credit cards.

Credit cards are not evil. Where people get in trouble is by charging against them without backup money in the bank.

I've never owned a credit card. All sorts of people advice me never to get them. Just the odd time where I really wish I had one. Ticketmaster, Ebay, etc etc. Just this past week I tried to get a membership at a Mens Bathhouse and they need a credit card on file. I was right pissed off.

Although I am poor I feel RICH $$$ By not owning a Credit Card. Albeit they are handy items As chopping and spreading instruments and make a great tool for opening stuck doors. I also like to snip them in half and paste them on the wall as decoration. So you see? I do take an INTEREST. In the NON-INTEREST aspect of hated plastic!